An article on Donor-Advised Funds authored by Atticus Technology and Bobby McDonald, President of South Carolina Christian Foundation

The Rise of Donor-Advised Funds

In the decade after 2012, Donor-Advised Funds (DAFs) grew by 411%. These accounts are now an essential part of the philanthropic landscape. For Major Gift Officers (MGOs), understanding DAFs is crucial to their success. Here’s Atticus’ guide to understanding the unique opportunities – and sometimes challenges – of navigating the DAF galaxy.

What is a Donor-Advised Fund?

A Donor-Advised Fund is a financial account a donor can contribute wealth to that is dedicated to donating to charity. A DAF is unique in that it is a:

- Charitable Account: Assets can only be moved out of the DAF if going to a qualified 501c(3) organization.

- Tax Deduction: Donors receive a tax deduction in the year they contribute assets to the DAF, even if those assets are not distributed to a nonprofit in that year.

- Advisory Role: Donors retain advisory privileges, meaning they can recommend grants from the DAF to qualified charitable organizations, but the sponsoring organization makes the final approval and therefore gift.

Why Donors Choose Donor-Advised Funds

DAFs provide a range of benefits that appeal to donors but most important are the following:

Tax Efficiency: Allowing the donor to cluster multiple years of giving into one windfall year can maximize deduction opportunities.

Tax Efficiency: Allowing the donor to cluster multiple years of giving into one windfall year can maximize deduction opportunities.- Tax Strategy: Wealth transferred into a DAF can be in many forms (cash, securities, real estate, etc.) and is not subject to capital gains tax. Rather than losing a chunk of their gift to taxes, they can give the entire amount in kind to the DAF and avoid those taxes. The money within the DAF will also continue to earn interest (depending on how the DAF sponsor organizes the fund), which will also continue to grow tax-free.

- Simplicity: Rather than keeping track of many giving receipts for their tax deductions, donors get one receipt from the DAF for their total charitable giving that year.

- Legacy and Family Engagement: DAFs allow families to engage in philanthropy across generations, providing a vehicle for charitable giving that can be passed down. If the account holder passes, control of the money within the DAF will go to the heirs.

- Confidentiality: DAF giving is undisclosed. Unlike private foundations, which must publish their grants to the IRS, DAFs are not required to disclose. (And yes, private foundations can give to a DAF which absolves them from disclosing their giving). This makes looking for DAF givers very difficult.

What an MGO Needs to Know About Donor-Advised Funds

Money in a DAF is no longer the donor’s money, legally speaking. Most DAF sponsors allow their donors (who are their clients) to decide where those donations should go but often only if within the DAF sponsor’s parameters. Consequently, a donor should and will pick a DAF sponsor that is aligned to their missional giving.

The Role of Donor-Advised Fund Sponsors

DAF sponsors are either financial institutions (like Fidelity Charitable) or Community Foundations.

Financial Institutions: These are large, often national sponsors that do not publicize a charitable mission. They are for-profit organizations like Fidelity or Charles Schwab..

Community Foundations: These are local, nonprofit organizations that manage DAFs for donors in a specific geographic area. They tend to have a mission that aligns with community-building and often play a key advisory role in helping donors make the most of their charitable giving.

| Financial Institutions | Community Foundations |

| National | Local |

| Not Explicitly Missional | Missional |

| Secular | Can be secular |

| For Profit | Non Profit |

The Influence of Community Foundations

Community Foundations want to attract more donors to their DAF programs because that’s how they grow. They work hard to meet donors’ needs and offer guidance on how to store and spend their donations wisely. The President or CEO of a Community Foundation, for example, has a lot of influence on the charitable giving decisions of their donors. Building relationships with these leaders can help you understand your donor’s giving strategy, give you access to new potential donors, and provide opportunities for your nonprofit to network with potentially like-minded people.

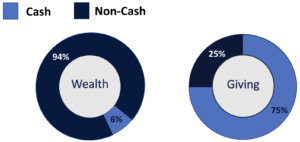

Donor-Advised Funds and Non-Cash Assets

Not all assets in a DAF are cash. Only 6% of wealth in the U.S. is held in cash. One of the advantages of giving (and receiving) gifts through a DAF is that these gifts don’t need to be cash. Donors can contribute their non-cash assets (like real estate, securities, etc.) into a DAF and avoid paying both capital gains and income tax on those assets.

A couple examples:

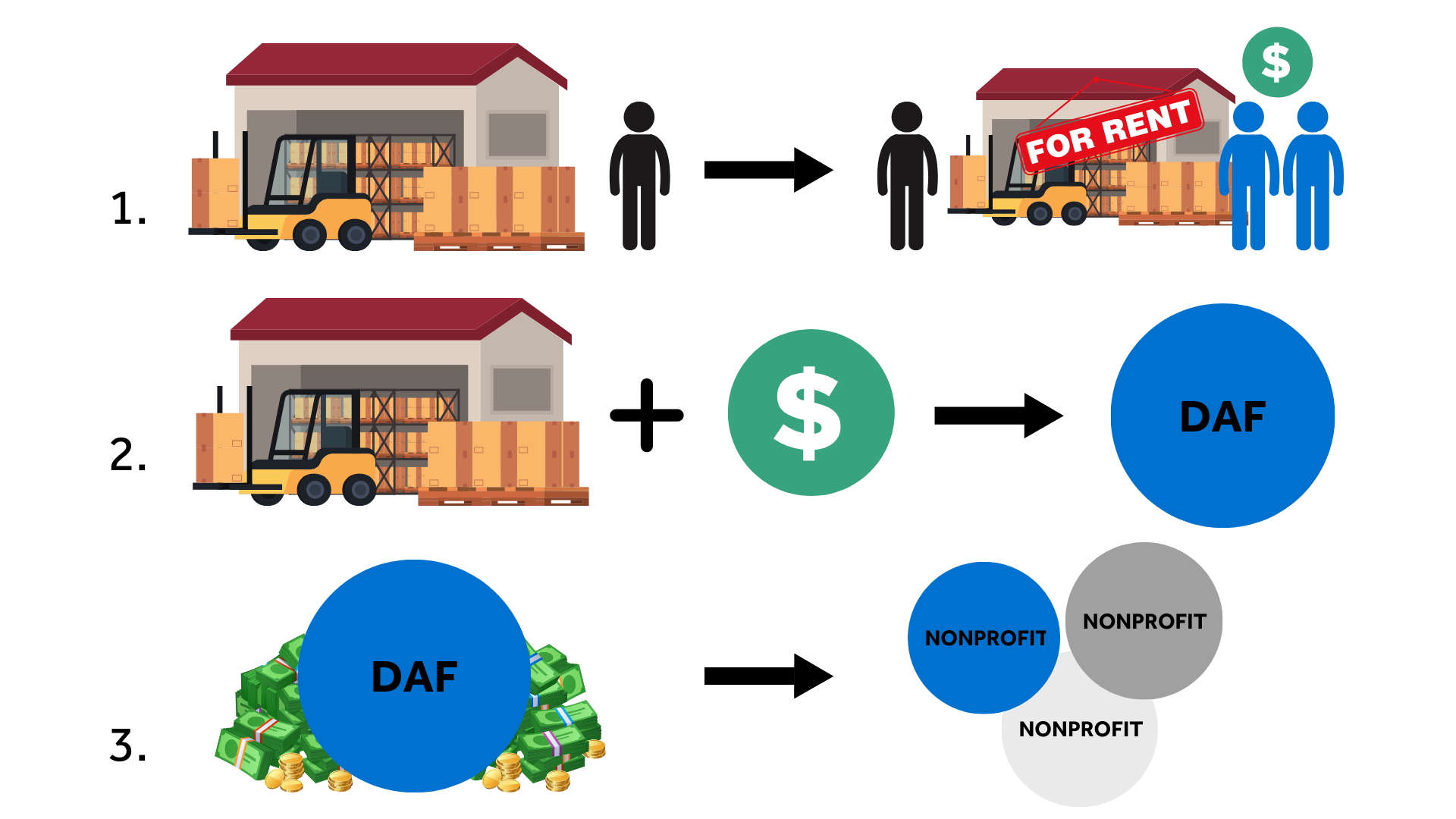

- A donor might buy a warehouse, rent it out for $10,000 a month, and then contribute that warehouse to a DAF. The rental income from that warehouse (now held in the DAF) is not subject to taxes. The donor can then direct the DAF to donate this income to your nonprofit.

A donor pledges to give $100,000 then goes and liquidates some investments for $125,000 so they can make the $100,000 gift and $25,000 capital gains tax bill. A helpful Major Gift Officer might point out that the donor should rather put the $100,000 of investments into a DAF and then gift it to their nonprofit, leaving $25,000 for the donor to give another day. Or better yet, give the full $125,000 through the DAF since they were prepared to part with it anyway.

A donor pledges to give $100,000 then goes and liquidates some investments for $125,000 so they can make the $100,000 gift and $25,000 capital gains tax bill. A helpful Major Gift Officer might point out that the donor should rather put the $100,000 of investments into a DAF and then gift it to their nonprofit, leaving $25,000 for the donor to give another day. Or better yet, give the full $125,000 through the DAF since they were prepared to part with it anyway.

These assets, once inside the DAF, can be liquidated by the DAF sponsor and made as cash gifts. They can also be made in kind to a qualified recipient. As an MGO, help your donors understand how they can use DAFs to structure their gifts for maximum impact. This opens the door to the other 94% of American wealth for your organization.

Donor-Advised Funds and Private Foundations

- Private foundations can donate to DAFs, and DAFs can give to other DAFs. This can make tracking donations more complicated for your research team. Sometimes a private foundation will simply move their required 5% distribution into a DAF – further increasing the growth of DAFs in philanthropy.

- DAFs are not required by law to donate a set percentage of their assets each year (unlike private foundations, which must distribute 5% annually). However, some DAF sponsors require their clients to give a certain percentage each year or the sponsor will redistribute it according to their own mission. Another reason it’s always good to know your local Community Foundation directors.

Click here for more information on different types of major giving.

Funding Strategies in the Brave New World of Donor-Advised Funds

As a Major Gift Officer, engaging with DAF donors requires a strategic approach and understanding of the unique characteristics of DAFs. Here are some key strategies for effectively engaging with donors and foundations:

| Importance of Community Foundations | Network with your local community foundations. These directors know and influence all the right people. |

| Be the advisor | Educate yourself on wealth management. If you can help your donors make savvy giving choices you will become invaluable to them. You may also think of some creative giving opportunities that enhance each gift you receive. |

| Know the industry | Understand the implied differences of someone who gives from a financial institution DAF and a Community Foundation – that donor made that choice for a reason. Understanding the difference will help you understand that donor. |

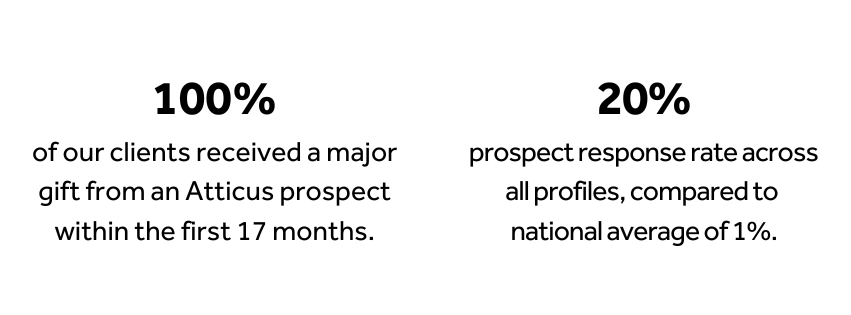

| Get help | Finding new donor prospects is very hard in the undisclosed giving world of DAFs. Partner with Atticus to find new major donors that can propel your mission. |

About Atticus Technology

We identify the few major donor prospects your organization needs. Atticus provides tailored sets of high-profile major donor prospects with in-depth profiles, curated insights, and expert engagement strategies for personalized outreach.

Click here to schedule a demo with a member of our sales team.

![]()

For more information about the South Carolina Christian Foundation, visit their website.